H1B Visa Guide 2025: Everything You Must Know to Avoid Costly Mistakes

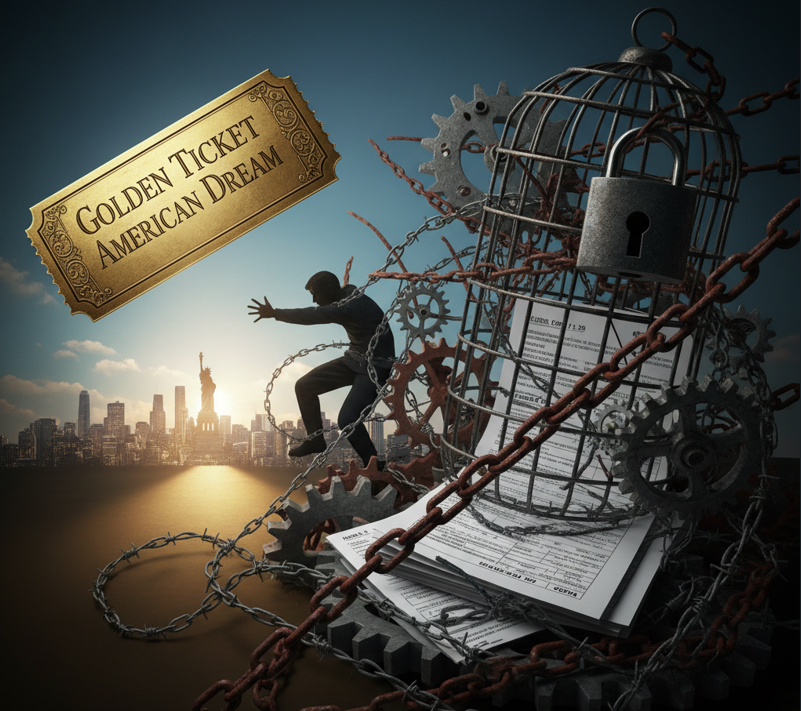

When people talk about working in the U.S., the first word that usually pops up is H1B. For many, it’s the magic key to Silicon Valley, fat paychecks, and that “American Dream.” But the reality? It’s way more complicated — a mix of opportunity, risk, bureaucracy, and sometimes, heartbreak.

Let’s break it down so you know exactly what you’re signing up for (or already dealing with).

📑 Table of Contents

What is the H1B Visa?

The H1B is a non-immigrant work visa that lets U.S. companies hire skilled foreign workers in specialized fields like IT, finance, engineering, medicine, research, and more. Think of it as America’s way of importing talent.

- Duration: Initially 3 years, extendable to 6 years.

- Employer-Tied: You can’t just hop jobs freely — your visa is linked to your sponsoring employer.

- Dual Intent: Unlike many visas, H1B allows you to apply for a Green Card while working on it.

So yeah, it’s powerful, but not without strings.

The H1B Lottery & Selection

Every year, the USCIS (U.S. Citizenship and Immigration Services) holds a lottery system because demand for H1Bs massively exceeds supply.

- Cap: 65,000 visas + 20,000 reserved for U.S. Master’s degree holders.

- Odds: Vary yearly, but roughly 20–30% selection rate in recent years.

- Selection ≠ Approval: Even if you win the lottery, USCIS still vets your application for eligibility.

So, getting an H1B is literally like winning a lottery ticket — only with way more paperwork and anxiety.

The H1B Application Procedure

If you’re planning to apply, here’s the road map:

- Employer Sponsorship: You can’t apply alone — a U.S. employer must file for you.

- LCA (Labor Condition Application): Employer files with the Dept. of Labor to prove you’re being paid fairly (no undercutting U.S. workers).

- Petition Filing (Form I-129): Employer submits this to USCIS.

- Lottery Selection: If picked, your petition moves forward.

- Approval & Visa Stamping: Once approved, you get your visa stamped at a U.S. consulate and head over to the U.S.

Sounds simple? Reality check: The paperwork is heavy, deadlines are brutal, and one small error can mean rejection.

Taxes & Salary on H1B

A lot of people think H1B = tax-free life. Nope. If you’re on H1B, you basically pay the same taxes as U.S. citizens:

- Federal income tax

- State income tax (depends on the state — no tax in Texas, Florida, etc.)

- Social Security (6.2%) + Medicare (1.45%) — yes, you pay into these even if you don’t retire in the U.S.

- Local/city tax in certain states.

💡 Pro tip: Since you’re considered a resident alien for tax purposes if you meet the substantial presence test, you can file taxes like a U.S. citizen and claim deductions (like dependents, mortgage, education).

Conditions & Limitations

Here’s where reality bites:

- Employer Control: You’re tied to your employer. Want to switch? Your new employer must transfer your H1B (and file paperwork).

- Layoff Risk: If you lose your job, you have 60 days grace period to find a new one or leave the U.S.

- Location Bound: You can’t just change job sites — USCIS approval is needed.

- Dependents: Your spouse/kids come on H4 visa. Spouses can work only if you (the H1B holder) are on track for a green card (EAD required).

Basically, the H1B is freedom with handcuffs.

Benefits of the H1B

- High Salaries: Tech & finance roles often pay significantly higher than in home countries.

- Green Card Path: Unlike most visas, H1B is a stepping stone to permanent residency.

- Networking & Growth: Exposure to U.S. work culture, skills, and global opportunities.

Risks & Consequences

- Immigration Backlog: Especially for Indians and Chinese, the green card wait can be 10–20 years.

- Uncertainty: Annual lottery + employer dependency = stress.

- Exploitation Risk: Some shady consultancies misuse the system, underpaying employees or “benching” them illegally.

- Lifestyle Cost: High U.S. living expenses can eat into your salary if you’re not careful.

Valuable Tips for H1B Holders & Aspirants

- For Applicants: Strengthen your profile — U.S. Masters/PhD degree massively improves selection odds.

- For Current Holders: Always keep backups. Network with other employers in case of layoffs.

- Taxes: Learn to use deductions smartly — many H1B folks overpay taxes because they don’t know the system.

- Investments: You can invest in U.S. retirement accounts (401k, IRA), stocks, and even real estate.

- Immigration Strategy: If you’re planning for a green card, start EARLY. Don’t wait until year 5.

Final Verdict: H1B – Dope or Nope?

So, is the H1B worth it?

- If you’re ambitious, skilled, and ready to grind through paperwork and uncertainty — Dope.

- If you’re looking for stability and freedom right away — Kinda Nope.

The H1B is a launchpad, not a destination. It gives you entry into the U.S. job market, but whether it turns into the dream life depends on how you plan, adapt, and navigate the system.

👉 If you’re dreaming about it — go for it.

👉 If you’re already on it — plan your taxes, keep an eye on immigration news, and start your green card journey ASAP.

While you’re figuring out your H1B plans, why not take a break and check out some of our other reviews? If you’re curious about movies too, we’ve got you covered — like our deep dive into Jawan and whether it’s still worth rewatching in 2025. From visa guides to movie reviews, dopeornopehub has all the insights to keep you in the know, whether it’s your career or your binge list.